How Much Money Do I Need To Buy A House Calculator Lindsay Fatinvand

HOW MUCH HOUSE CAN YOU AFFORD?

Lenders usually don't want you to spend more than 31% to 36% of your monthly income on principal, interest, property taxes and insurance. Let's say your total monthly income is $7,000. Your.

How Much House Can I Afford With 100K Salary? Top Considerations

Combined with their debt payments, that adds up to $1,200 - or around 34% of their income. House #2 is a 2,100-square-foot home in San Jose, California. Built in 1941, it sits on a 10,000-square-foot lot, and has three bedrooms and two bathrooms. It's listed for $820,000, but could probably be bought for $815,000.

How much house can I afford? Buying your first home, Shop house plans

For example, if you're thinking of a total monthly housing payment of $1,500 and your income before taxes and other deductions is $6,000, then $1,500 ÷ $6,000 = 0.25. We can convert that to a percentage: 0.25 x 100% = 25%. Since the result is less than 28%, the house in this example may be affordable. In addition to deciding how much of your.

HOW MUCH HOUSE CAN YOU AFFORD? Buying a home YouTube

The question isn't how much you could borrow but how much you should borrow. These home affordability calculator results are based on your debt-to-income ratio (DTI). Industry standards suggest your total debt should be 36% of your income and your monthly mortgage payment should be 28% of your gross monthly income. Learn more.

Budgeting For Your New Home The First Step CotswoldHomes

To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly income on home-related costs and 36% on.

How Much Money Do I Need To Buy A House Calculator Lindsay Fatinvand

See below for estimated DTI percentages and how they relate in terms of your budget (what you can afford in monthly payments based on the information you have provided). 20-27%. Quite affordable.

I make 70000 a year How much house can I afford Money Bliss

How we calculate how much house you can afford. Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved for a down payment, and what your monthly debts or spending looks like. This estimate will give you a brief overview of what you can afford.

How Much House Can I Afford 2021 Affordability Calculator

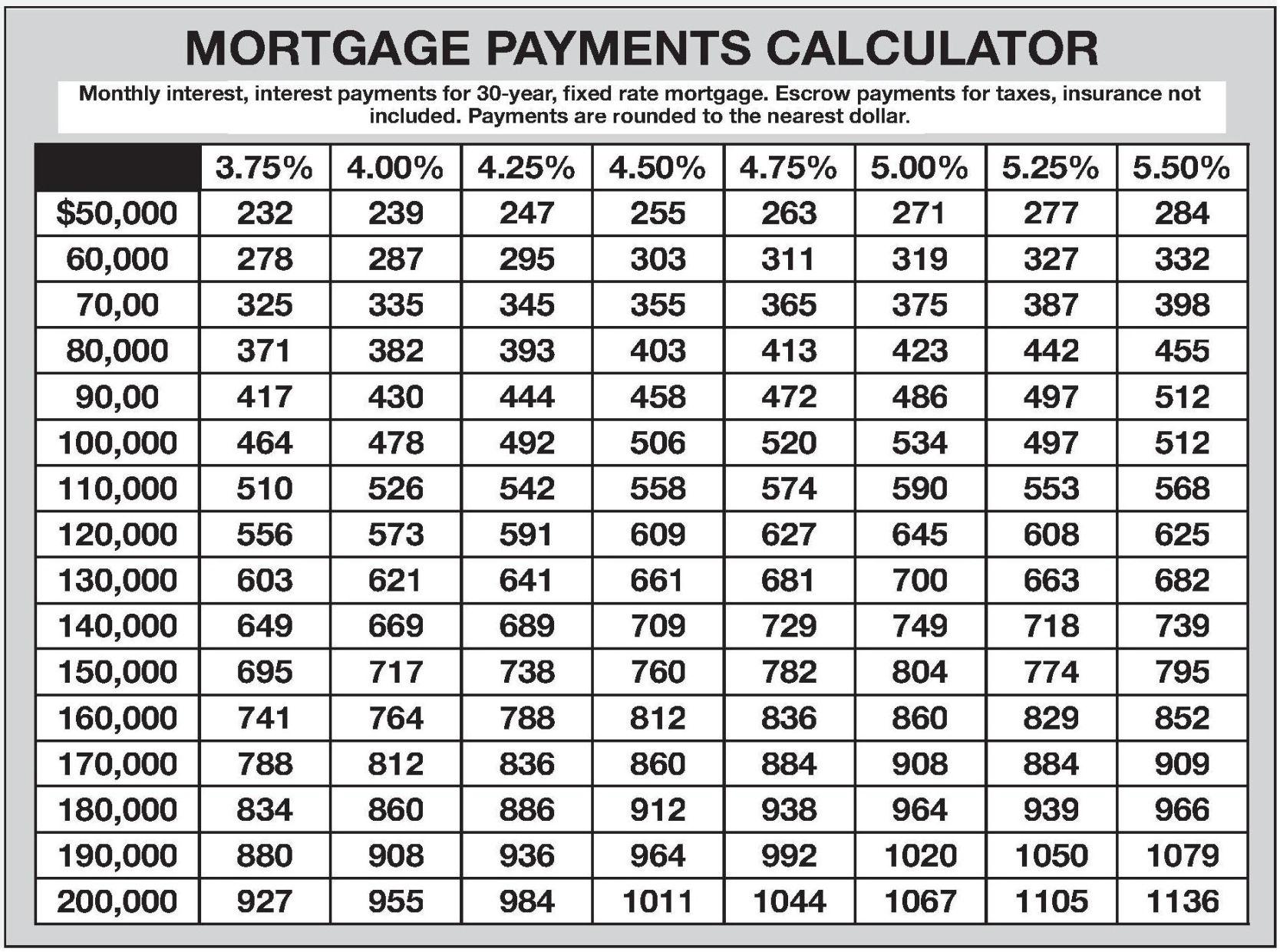

n: Number of payments over the life of the loan. Multiple your loan term by 12 to determine the total number of payments. For example, a 30-year fixed-rate loan will have 360 monthly mortgage.

How Much House Can I Afford? Quick Guide To Home Affordability

How to figure out your DTI. Add up your total monthly debt and divide it by your gross monthly income, which is how much you brought home before taxes and deductions. Here's an example: Now.

How Much House Can I Afford? Buying first home, First time home

To get the best mortgage loan, know how much you can afford and shop like the bargain hunter you are. Read more Down Payment Assistance: How to Get Help Buying a House

How Much House Can I Afford? Mortgage, Affordable, Mortgage payment

For example, closing costs can be 2 - 5% of a home's price. Taxes and insurance also add to your mortgage payment. Understanding these numbers helps give you a more realistic idea of what's affordable.

How Much House Can I Afford With Pmi MUCHW

Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Find out how much you can afford with our mortgage affordability calculator. See estimated annual property taxes, homeowners insurance, and mortgage insurance premiums along with your.

How Much House Can I Afford? Insider Tips and Home Affordability Calculator

The amount of money you spend upfront to purchase a home. Most home loans require a down payment of at least 3%. A 20% down payment is ideal to lower your monthly payment, avoid private mortgage insurance and increase your affordability. For a $250,000 home, a down payment of 3% is $7,500 and a down payment of 20% is $50,000.

How much house can I afford How Do I Calculate How many houses I Can

To get a quick answer to how much house you can afford, you can use a home affordability calculator. NerdWallet's calculator uses the 28/36 rule as a baseline. NerdWallet's calculator uses the.

It's important to know how much home you can afford before you start

Step 2: Divide By Gross Income. Next, divide your total monthly debts by your monthly gross income. For example, let's say your debt payments add up to $4,000 per month. If your monthly gross income (your before-tax income) is $8,000 per month, then your DTI is 0.5, or 50%.

How To Calculate How Much House Can I Afford Theme Loader

How Much House Can I Afford? Home Buying - 11-minute read Wondering how much house you can afford? Learn more about how to figure out how much you can spend on a mortgage and use our home affordability calculator here. Rocket Sister Companies Buy a home, refinance or manage your mortgage online with America's largest mortgage lender¹.