Mortgage calculator payments warriorkesil

Amortization schedule excel datinglio

Reset. $4,000 New temporary mortgage payment. Existing monthly first mortgage payment $3,000. Additional amount paid each month $1,000. New temporary mortgage payment $4,000. Disclaimer. In order to receive a helpful estimate, it's important that you input accurate information. Results reflect a potential estimated plan for repaying your.

Mortgage calculator How much will your monthly payments cost

This mortgage calculator will help you estimate the costs of your mortgage loan. Get a clear breakdown of your potential mortgage payments with taxes and insurance included. Home price. Down.

How To Calculate The Monthly Interest and Principal on a Mortgage Loan

A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. The Loan term is the period of time during which a loan must be repaid. For example, a 30-year fixed-rate loan has a term of 30 years. An Adjustable-rate mortgage (ARM) is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan, based on the.

Compare Home Mortgage Interest Rates by Decade [INFOGRAPHIC] Denver

Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates & more.. Mortgage Repayment Summary. $2,721.94 Total Monthly Payment PMI not required $80,000.00.

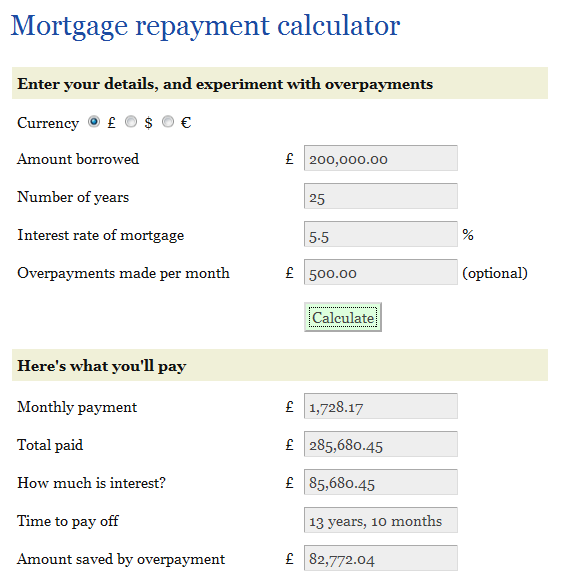

The best mortgage repayment calculator out there Miss Thrifty

Use our Mortgage Calculator to calculate the full details for any mortgage you have. You can add as many mortgages as you like by clicking the add new mortgage button! The calculator will show you the monthly repayment, interest only amount, total repayments and final cost of credit for each mortgage you enter. Mortgage Amount.

Mortgage calculator payments warriorkesil

The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages.. and the buyer agrees to repay the money borrowed over a period of time, usually 15 or 30 years in the U.S. Each month, a payment is made from buyer to lender.. which comes out to 0.5% in interest every month. Costs.

Mortgage Fundamentals — an Illustrated Tutorial

So if you paid monthly and your monthly mortgage payment was $1,000, then for a year you would make 12 payments of $1,000 each, for a total of $12,000. But with a bi-weekly mortgage, you would.

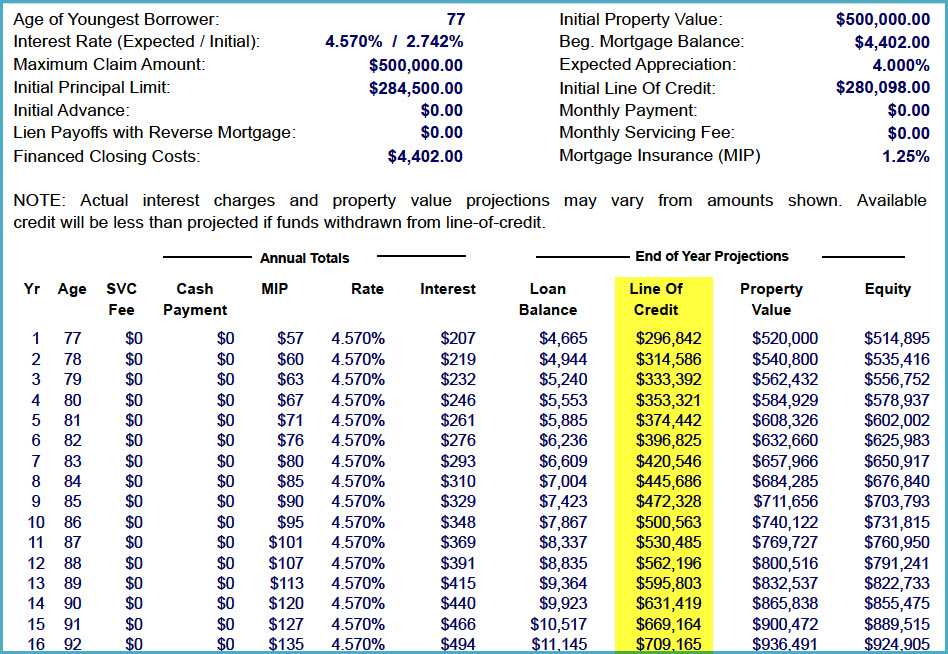

Understanding the Reverse Mortgage Amortization Schedule

For instance, if you're borrowing $360,000, you might pay between $1,800 and $3,600 for mortgage insurance. Principal, interest, property taxes, HOA costs, home insurance fees, and PMI are added.

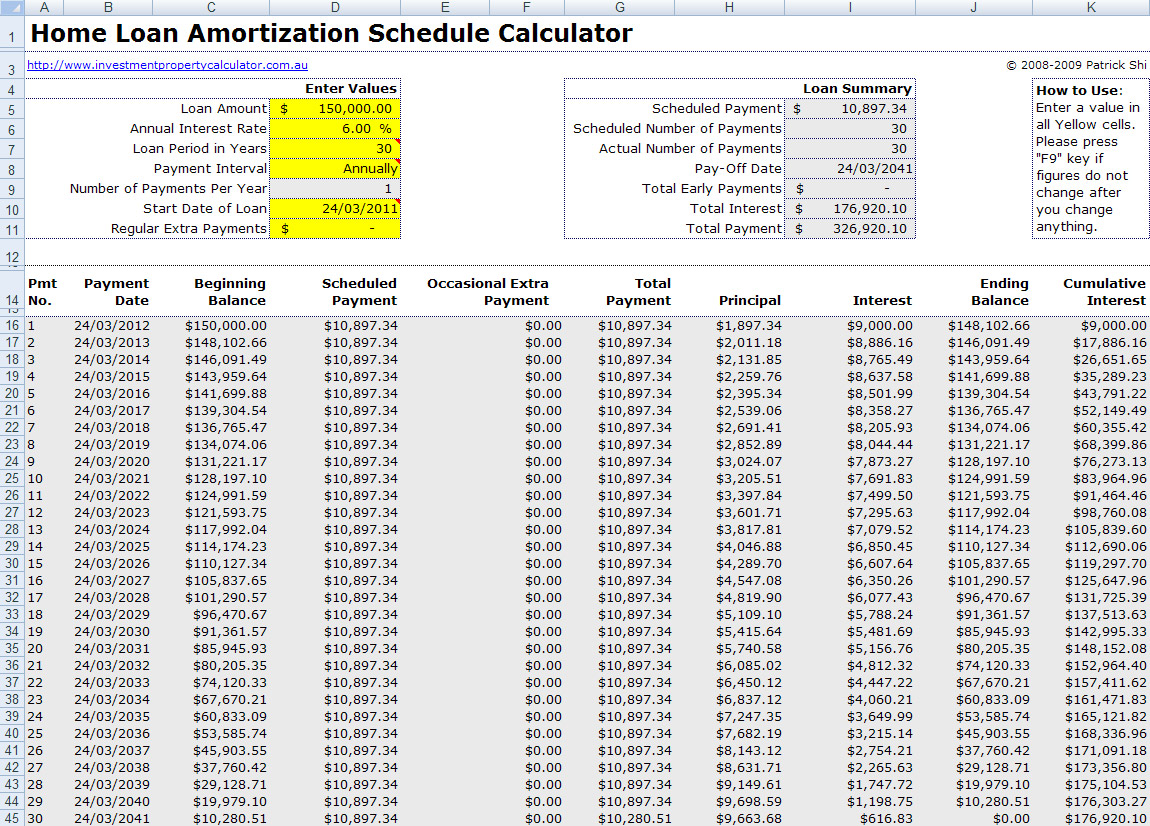

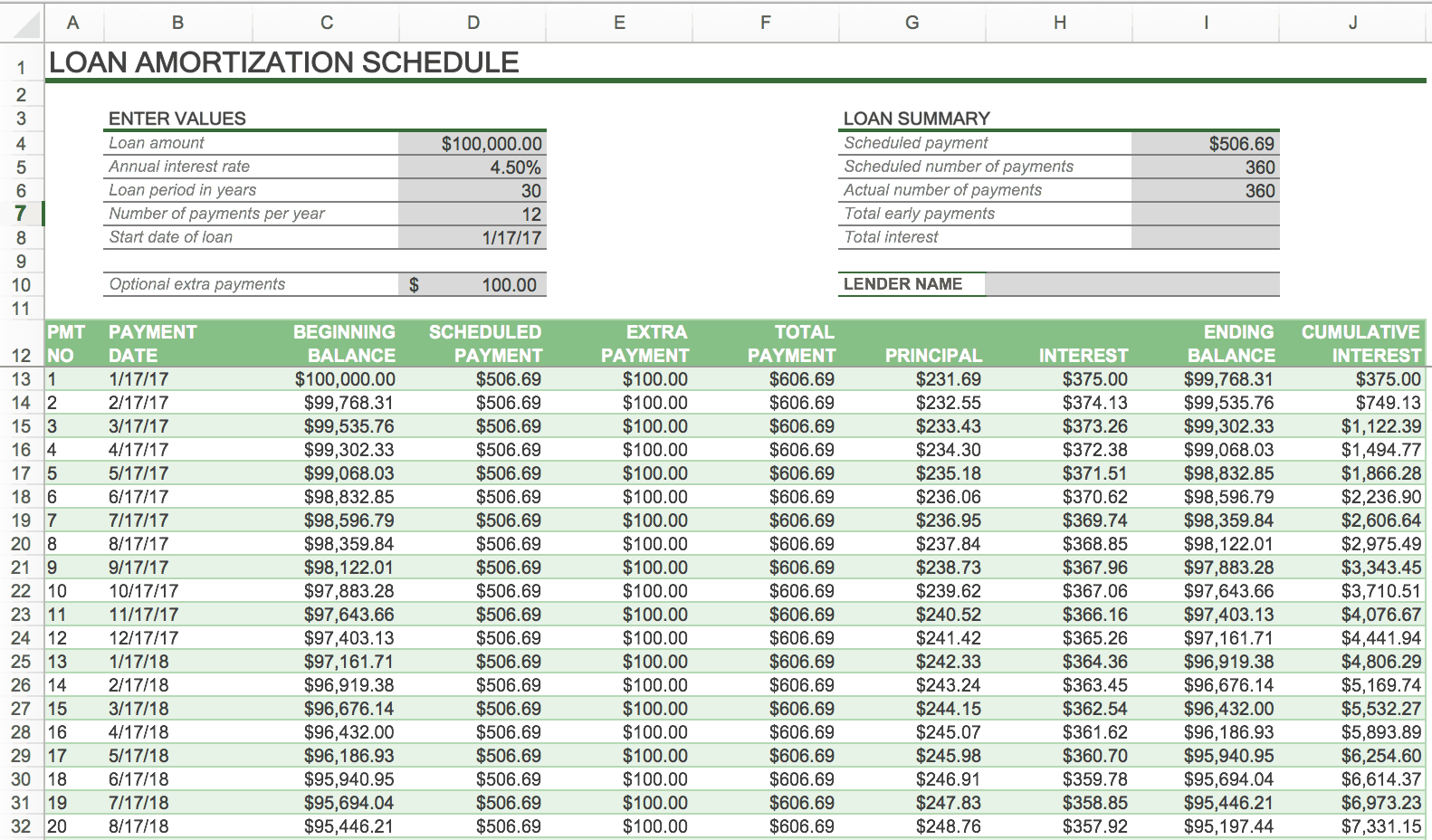

Understanding Amortization Schedules Calculation, Formulas, and

The answer depends on several factors including your interest rate, your down payment amount and how much of your income you're comfortable putting toward your housing costs each month. Assuming an interest rate of 6.9% and a down payment under 20%, you'd need to earn a minimum of $150,000 a year to qualify for a $400,000 mortgage.

FREE 14+ Home Mortgage Calculator Samples & Templates in Excel Format

The amount of money you spend upfront to purchase a home. Most home loans require a down payment of at least 3%. A 20% down payment is ideal to lower your monthly payment, avoid private mortgage insurance and increase your affordability. For a $250,000 home, a down payment of 3% is $7,500 and a down payment of 20% is $50,000.

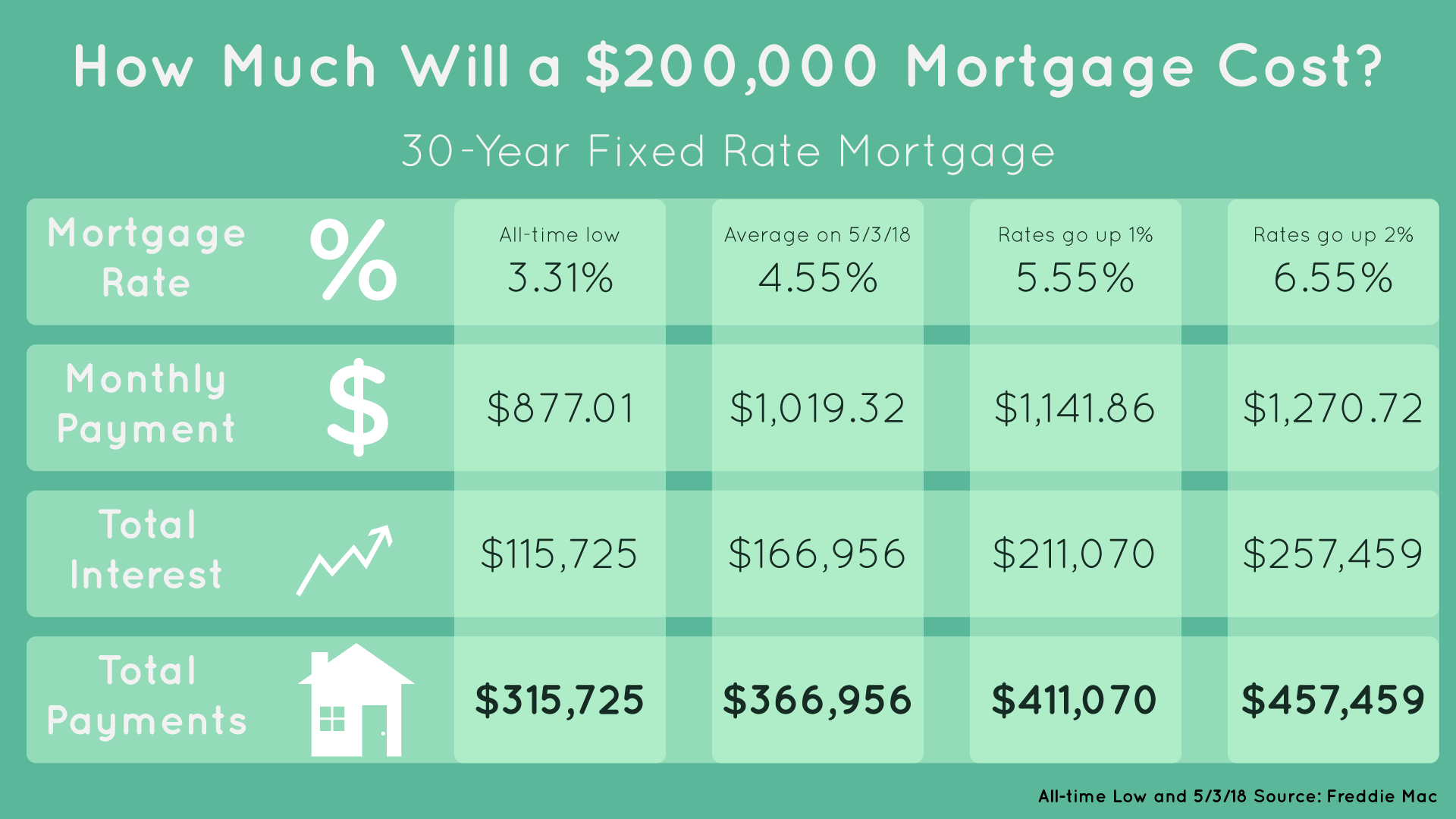

Buying a Home? Rising Mortgage Rates Are One Consider... Ticker Tape

This mortgage calculator shows you how much you'll pay toward your principal and interest each month, but your actual mortgage payment will likely include a couple other charges. Principal: This.

Free Home Mortgage Calculator for Excel

Total monthly mortgage payment. P. Principal loan amount. r. Monthly interest rate: Lenders provide you an annual rate so you'll need to divide that figure by 12 (the number of months in a year.

How to Calculate Monthly Mortgage Payment in Excel Using Function Excel

The most significant factor affecting your monthly mortgage payment is the interest rate. If you buy a home with a loan for $200,000 at 4.33 percent your monthly payment on a 30-year loan would be $993.27, and you would pay $157,576.91 in interest.

Mortgage Amortization Schedule Excel Template

Monthly Payment Amount. $ 1,799. Total Cost of Mortgage. $ 647,515. Total Interest Paid. $ 347,515. Formula. Monthly payment = P i (1+i) ^ n / (1+i) ^ n - 1. P - the principal, or the initial borrowed amount i - interest rate per repayment period n - number of payments over the life of the loan.

FREE 6+ Payment Calculator Mortgage Samples in PDF Excel

P=L [c (1+c)^n]/ [ (1+c)^n-1] P = the payment. L = the loan value. c = the period interest rate, which consits of dividing the APR as a decimal by the frequency of payments. For example, a loan with a 3% APR charges 0.03 per year or (dividing that by 12) 0.0025 per month.

Bi monthly mortgage payments calculator MaryannCodi

The mortgage payment calculation looks like this: M = P [ i (1 + i)^n ] / [ (1 + i)^n - 1] The variables are as follows: M = monthly mortgage paymentP = the principal amounti = your monthly.